$GLNT Tokenomics: Building Sustainable Economics for the Analyst Economy

Token Sale Begins November 21st

The $GLNT token powers the analyst economy, a new economic model where blockchain analysts earn directly from the value their insights create. Here’s how the token works, why it matters, and what makes the economics sustainable.

Token Fundamentals

Ticker: GLNT

Total Supply: 1 billion GLNT (fixed, no inflation)

Token Launch Price: $0.018

Fully Diluted Valuation: $18 million

Token Sale Date Start Date: November 21st, 2025

Why Tokenize the Analyst Economy?

Most analytics platforms keep all the value they generate. Analysts create insights that traders rely on, but capture almost none of the upside. They might get a one-time payment if they’re lucky. Usually they get nothing.

Tokenization changes this. When analysts create valuable dashboards on Glint Analytics, they earn $GLNT tokens. As the platform grows and more traders rely on these insights, the token’s utility increases. Analysts don’t just get paid once. They benefit from the long-term growth they help create.

The $GLNT token solves coordination problems impossible in traditional models:

Analysts need sustainable income to justify their time investment

Projects need authentic coverage without extractive intermediaries

AI agents need a standardized payment method for accessing intelligence

Communities need to coordinate quality control without central authority

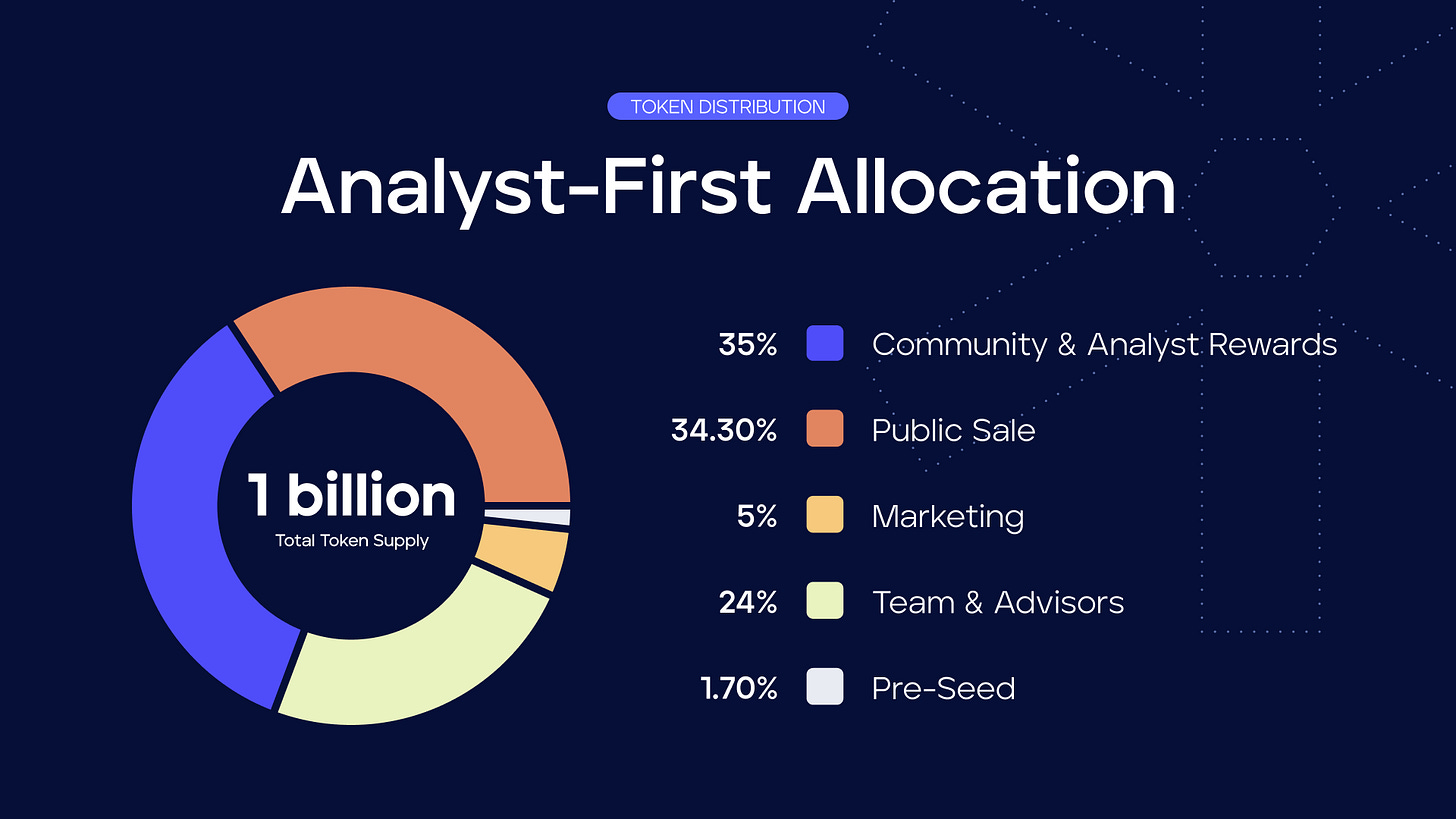

Token Distribution: Analyst-First Allocation

35% Community & Analyst Rewards (350M GLNT)

The largest allocation goes to the people creating value. Distributed over 36 months to analysts based on dashboard engagement, quality, and usefulness.

34.3% Public Sale (343M GLNT)

Fair launch across multiple launchpads ensures broad distribution.

5% Marketing (50M GLNT)

Strategic partnerships and growth initiatives.

24% Team, Advisors & Reserve (240M GLNT)

19.9% Core Team (199M GLNT): 6-month cliff, 30-month linear vest aligning team with long-term success

4.10% Advisors (41M GLNT): 24-month vest

1.7% Early Investors (17M GLNT)

Angel, pre-seed, and KOL rounds with conservative vesting (0-2 month cliff, 18-month vest) to prevent early dumps.

How Analysts Earn $GLNT

The reward system is designed to recognize value creation. When analysts create dashboards that traders find useful, they earn $GLNT tokens. The system weighs quality signals over vanity metrics. Time spent analyzing a dashboard matters more than quick views. Someone building on your work signals real value.

Analysts see their earnings grow in real time as their insights prove valuable. Historical dashboards continue earning if they remain relevant. Quality evergreen content gets rewarded long-term.

Projects can also commission specific analyses by posting bounties in $GLNT. Analysts compete for these opportunities, and winners earn both the bounty and ongoing rewards as their dashboards attract engagement. Useful insights earn more than noise.

Token Utility

Analyst Rewards

Primary utility. Create valuable analysis, earn $GLNT when traders find it useful. The more your insights help people make better decisions, the more you earn. Direct economic relationship between intelligence creation and value capture.

Reputation & Trust Signals

$GLNT enables reputation mechanics. Analysts will be able to stake tokens to signal commitment to quality. Community members will also be able to stake on analysts they trust. Higher stakes create stronger trust signals and better visibility. All onchain, verifiable and transparent.

Platform Governance

Token holders participate in key platform decisions. How should rewards be distributed? What features matter most? How should the treasury be allocated? As the network grows, these decisions shift increasingly to the community. Governance activates once the network reaches sufficient scale.

Economic Participation

The token creates multiple ways to participate in platform economics beyond creating dashboards. Staking mechanisms, liquidity provision, and other economic activities all route value to token holders. The goal is aligning everyone around the platform’s long-term success.

Ecosystem Development

Projects need $GLNT to commission insights and participate in the analyst economy. AI agents will use $GLNT to access verified intelligence through APIs. Premium features and advanced tools create additional utility. As the ecosystem expands, so does token utility.

Value Accrual Mechanisms

Revenue Buyback & Burn

A portion of platform revenue buys $GLNT on the open market and burns it permanently. This creates deflationary pressure as the platform scales. More revenue means more buybacks. Fixed supply meets growing demand.

Staking Locks Supply

Token holders who stake their $GLNT for reputation or other mechanisms remove tokens from circulation. This reduces liquid supply while the network grows, creating scarcity alongside expanding utility.

Network Effects Drive Demand

More analysts create more insights. More insights create more value. More value attracts more traders and projects. More traders and projects need more $GLNT. The flywheel accelerates as the network scales.

Governance Premium

Active governance participation adds meaningful value. Communities that actually direct their platforms trade at premiums. Token holders with real influence over a growing ecosystem capture more value than passive speculation.

The model works because it’s built on real economics. Platform revenue from subscriptions, API fees, and commissioned insights funds the reward pool. No dependence on new token sales. The community allocation vests over 36 months, so there’s no supply shock. Multiple revenue streams mean the platform doesn’t live or die by token price.

Governance evolves with the network. Starts centralized to move fast, transitions to community control as we scale. Meanwhile, demand comes from actual use cases. Projects commissioning insights. AI agents accessing intelligence. Premium features creating utility. Real demand, not speculation.

Token Sale Details

Date: November 21st, 2025

Price: $0.018 per GLNT

Public Allocation: 343.4M GLNT (34.3% of supply)

The analyst economy doesn’t exist yet. It will.

$GLNT is the economic layer that makes it possible. Aligning analysts, projects, traders, and AI agents around quality blockchain intelligence.

Learn more and prepare for the token sale at glintanalytics.com

The 43% allocation to comunity and analyst rewards is a solid approach. Most projects talk about rewarding creators but dont back it up with actual token distribution. The buyback and burn mechanism tied to platform revene should help with long term value accrual as usage grows. Intrested to see how the quality signals play out in practice when analysts start competng for engagement.